Using ESG Dynamics data and technology, Environmental Defense Fund published a new study investigating the environmental and climate implications from recent oil and gas M&A activity. EDF sought to partner with ESG Dynamics for our industry-leading ESG data analytics. The case studies demonstrate the importance of data-driven decisions when entering any oil and gas asset transaction.

By analyzing integrated environmental data from multiple sources, companies can identify ESG trends like flaring increases or accumulating abandoned wells. Recognizing those issues allows operational changes to elevate performance, in turn improving public perception. A New York Times article featured the EDF report – clearly, the public and investors care about the environmental ramifications of A&D decisions.

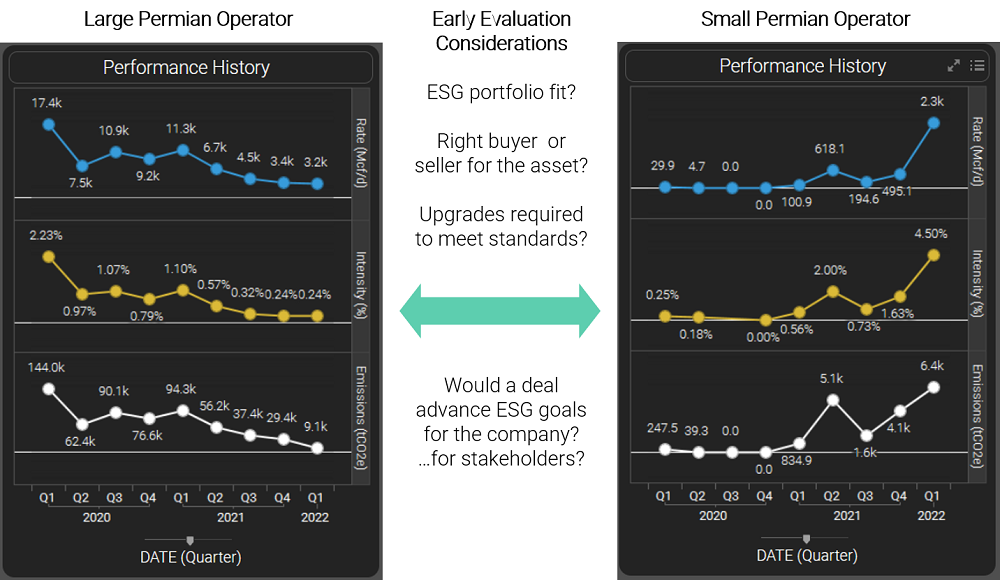

When it comes to planning a transaction, all parties involved will benefit from an early evaluation of the assets’ environmental history. Advance due diligence of potential buyers or sellers’ ESG performance profiles may guide counterparty selection aligned with ESG goals. Likewise, financial institutions and insurers now need up-front data analysis to address environmental and climate-related risks of proposed transactions.

ESG Dynamics cloud-based analytics modules make these evaluations quick and easy for any stakeholder, for better asset transaction planning and ESG-friendly decisions.

Read the EDF Report: Transferred Emissions: How Risks in Oil and Gas M&A Could Hamper the Energy Transition

Contact us at info@esg-dynamics.com to see our data analytics modules in action. We’re here to discuss how our tools and consultants could quickly identify environmental concerns for your upcoming deals.